“Use it up. Wear it out. Make it do or do without.”

A classic from the Great Depression, and the heart and soul of the Massachusetts Community Climate Bank, or “Green Bank” as it is more widely understood. At the heart of this initiative is the desire to transform what was a catastrophic pandemic and unprecedented transformation in the way we work into a smarter, more resilient way to address the ongoing housing crisis.

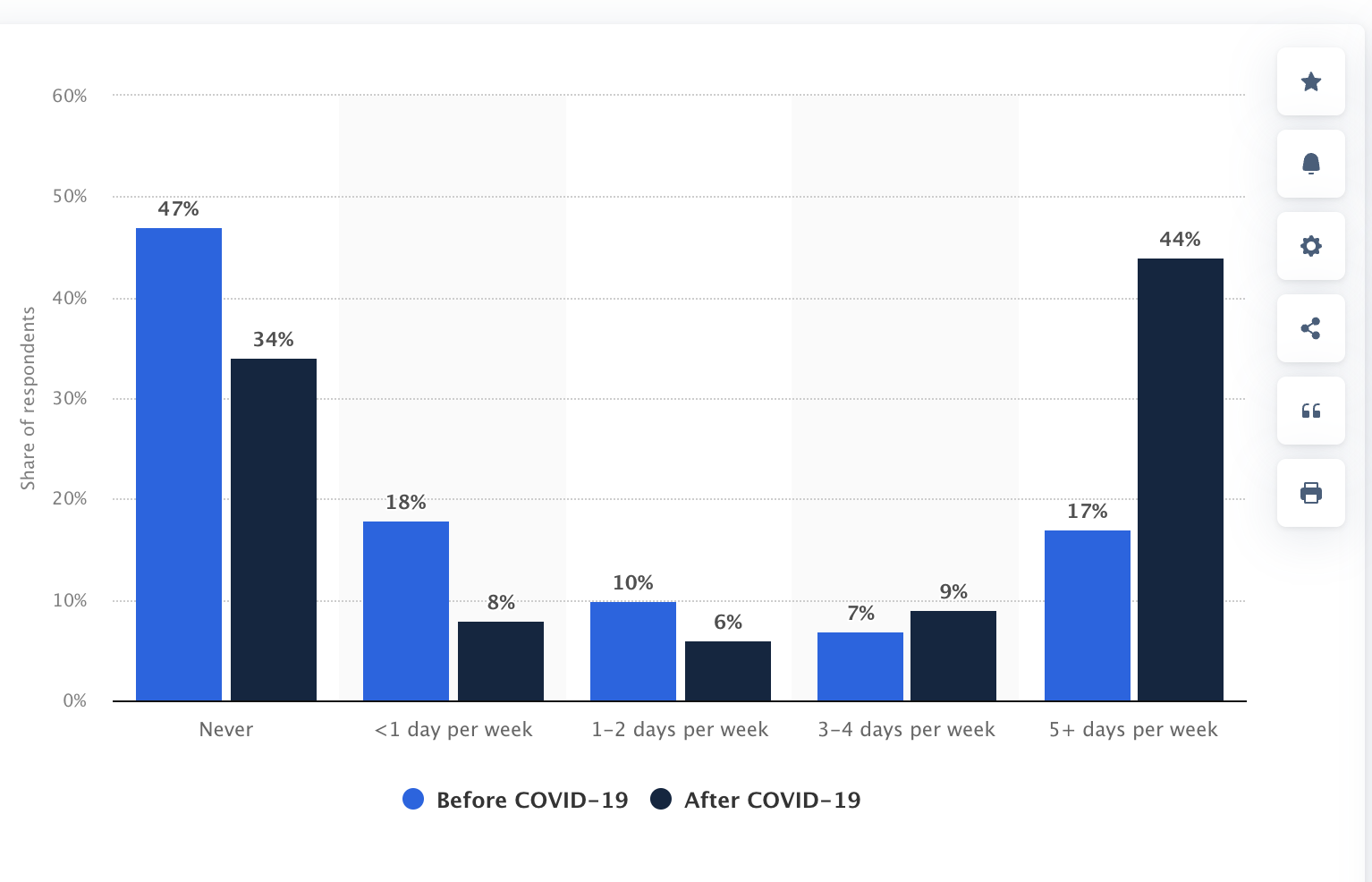

COVID-19 forced everyone who COULD work from home TO work from home, and while a steady migration back to the office has occurred in certain industries and in certain states, overall, the proliferation of hybrid and remote work models appears to very much have established itself as a new norm.

—Statisa.com

The result? Vacant commercial office real estate all over the country.

Before 2020, the quarterly vacancy rate was around 12 percent, but as the pandemic unfolded, it climbed to above 15 percent. In the first quarter of 2023, about 16.1 percent of office space across the country was vacant.

Massachusetts lawmakers couldn’t help but notice this trend occurring right alongside a 7.3 million unit housing crisis shortfall all across the nation. Empty commercial real estate and prospective residents in need? Behold the Green Bank

Understanding the Green Bank

Essentially, the Massachusetts Community Climate Bank is endeavoring to solve several issues at once. First, it aims to provide funding to transform conventional empty office spaces into affordable housing units. Simultaneously, the Green Bank is meant to help Massachusetts achieve its lofty climate and carbon impact objectives. By repurposing empty office space (whose maintenance and existence inflicts a carbon footprint) into affordable housing, it can create a new supply of affordable units for residents without the environmental impacts that come with outright and widespread new construction.

And while the mechanical action of repurposing one space for another is inherently sustainable, Green Bank funding is specifically designed to engender the creation of energy-efficient housing units that align with the state’s decarbonization objectives, reducing the overall greenhouse gas emissions of this new supply of units.

Obstacles and Headwinds

As anyone who has ever tried to overnight in an office space knows—they’re fundamentally not living spaces. Converting working commercial real estate into residential units isn’t without its challenges. It’s expensive; It’s labor intensive; And the added pressures of sustainable construction further complicate the process.

- HVAC System Conversion: More often than not, office buildings use a centralized HVAC system. For residential units to function properly, this system has to be converted to supply and meter individual units.

- Plumbing: Offices have break rooms and bathrooms. Residential units, on the other hand, have kitchens and washers and multiple bathrooms and showers and all manner of water transportation needs. That veritable spiderwork of infrastructure has to be installed to make the spaces functional

- Decarbonization. Sustainability goals mean higher standards and more regulation. Better equipment, sustainable supply chains, more resilient materials, and more reporting to meet regulatory needs: it all comes with an associated cost.

While most of these issues boil down (as most issues inevitably boil down) to cost and labor, that is fundamentally why the Green Bank exists. It is, at its heart, a financial support system meant to alleviate these challenges and incentivize developers. The hope of the initiative is that enough strategic financial support will make office conversions more financially viable and more enticing to prospecting developers.

When will the Green Bank Initiative Launch?

According to Massachusetts officials, the Green Bank is set to formally launch by the end of the year. What’s more, the initial signs seem promising. A reporter on the Radio Boston program has indicated that developers are showing interest. The combination of Green Bank financial support and the Inflation Reduction Act (IRA) seems to have elicited a positive response from developers throughout the state. Only time will tell if enough businesses will be willing to take the plunge to make the initiative an overall success.

Other states will no doubt be watching closely. Massachusetts is not alone in its widespread vacant commercial real estate, and the housing crisis has rained on the heads of municipalities all across the U.S. If Massachusetts’s investment results in widespread affordable housing and more achievable climate initiatives, you can bet other legislative bodies will follow suit.

Subscribe To Our Blog Newsletter

Keep yourself ahead of the curve with the latest utility news, trends, & resources.

Editor's Picks

Climate Risk Is Now a Portfolio Allocation Question, Not a Reporting Exercise

A practical framework for screening climate risk in multifamily portfolios and identifying market and asset hotspots.

Keep the Heat On: Utility Assistance Resources for Property Teams This Winter

Record-breaking cold across the East is driving heating costs higher and putting pressure on residents and property teams alike.. Meanwhile, in our headquarters in Utah, we’re still scanning the mountains for snow (we’re not bitter). But across the country, winter…

Exploring the YoY Energy Price Hikes

Why Doing Everything Right Still Costs More First the lightning. Then the thunderclap. Right? The lightning. Over the last 18 months, AI, in all of its many and emerging forms, roared across the U.S. And while cultural and enterprise hesitance…

Onboard Is Now Conservice Internet Management

Since 2017, Onboard has been singularly focused on transforming how internet is delivered, supported, and monetized in the real estate industry. We’ve built a platform that simplifies bulk and non-bulk internet programs for owners, enhances the resident experience, and drives…

Senior Living Runs on Care (and Careful Utility Management)

Senior living operations exist for one main reason: to support residents. Every role, every process, and every decision ultimately serves people, not just systems. That focus is what makes the industry unique. And it’s also what makes operational strain show up more quickly when something falls out of balance.

The NOI Drain You Can’t See: How Utility Billing Errors Quietly Undermine Portfolio Performance

Identify and recover hidden utility billing errors that quietly drain NOI. Learn how a utility bill audit, automation, and expert review improve budget accuracy across multifamily and commercial portfolios.

Mid-Lease Enrollments: You’ve Signed a Bulk Internet Contract—Now What?

Signing an internet management contract is a big step forward. You’ve secured better pricing, guaranteed service levels, and one of the most in-demand amenities for your residents. But once the ink is dry, the real work begins: getting residents enrolled.

What the 2026 GRESB Updates Mean: Our Observations on the Key Shifts

Change is on the horizon. The 2026 GRESB Real Estate Standard marks a decisive move toward measurable, performance-based climate action. Rather than incremental adjustments, these updates focus attention on the issues that most directly shape long-term value and resilience. GRESB…

California AB1414: New Bulk Internet Opt-Out Law—What You Need to Know

New Requirements Go Into Effect January 1, 2026 California has officially passed AB1414, a bill that changes how property owners and operators can offer bulk internet services to residents. Beginning January 1, 2026, property owners must allow residents the ability…

Built to Go the Distance: How Properties Achieve ENERGY STAR, LEED, and WELL Certifications

We recently held our first 5K for our team, and it got us thinking. We watched many of our Experts who hadn’t run in years (or ever) lace up, train for weeks, and push through on the big day. The…

Experience Effortless Utility Management and Cost Savings

Connect with us today to discover how our solutions can ease tenant billback, streamline utility management, and reduce your costs and energy usage. Make your utility management smarter and more efficient with Conservice!