It’s a good time to be a renter.

It’s a bad time to be a home buyer.

And it’s a…strange time to own or manage rental properties.

Every January, we at Conservice build a snapshot of the rental industry and share it on our blog. Every player in property management, from providers to vendors to property management firms themselves, sees a different angle on the trends impacting our industry. We’ve always felt (and according to our stats, so have our readers) that our niche as the largest managed utilities provider in the U.S. gives us an especially unique and valuable perspective.

But the last few years have been a strange time to collate industry trends. And this year, building a throughline of likely economic trends and wise strategies feels a little like boxing an empty coat. We’ve thrown our punches—thought leaders all over the country have thrown their punches—and for as many blows as have landed, very few rock-solid answers or insights have emerged. So we’ve decided to lay out some of the more significant powers and factors influencing the way our industry does business.

From Rocketing Multifamily Growth to Flat Rents

The years of unprecedented growth in the Multifamily space—along with the incredible factors that supported it—appear to be flattening. Ferociously low inventory and COVID lockdownees desperate to enhance their living situations led to a mad scramble for new accommodations. The result? Skyrocketing rents all over the nation, a grueling combination of high inflation, stagnant wage growth, and our own industry’s springboard into the build-to-rent space. Mix it all together and you’ve got a cost-capped customer base and a stiffening inability to raise rents.

According to a Realtor.com report from late last year, median rents fell by as much as .7% year-over-year. In fact, according to the report, the median asking rent across the 50 largest metropolitan areas in the U.S. hit $1,747 in September—a $29 decrease from its peak in July 2022. It’s a trend that, while varied, has more or less continued into early 2024. Rents throughout the U.S. have either significantly slowed their growth, or outright fallen. Rental concessions, the likes of which we haven’t seen in almost five years, have begun to creep back into new prospect offerings as competition to close vacancy rates has climbed.

And speaking of vacancy rates…they’re up. The influx of multifamily growth over the last several years led to a storm of new construction across the country. There are over a million multifamily rental units underway which, combined with a Fannie-May predicted rent growth of 1 to 1.5% this year, is contributing to an expected vacancy rate rise to 6.25%.

Rents Have Also Risen—In Some Regions

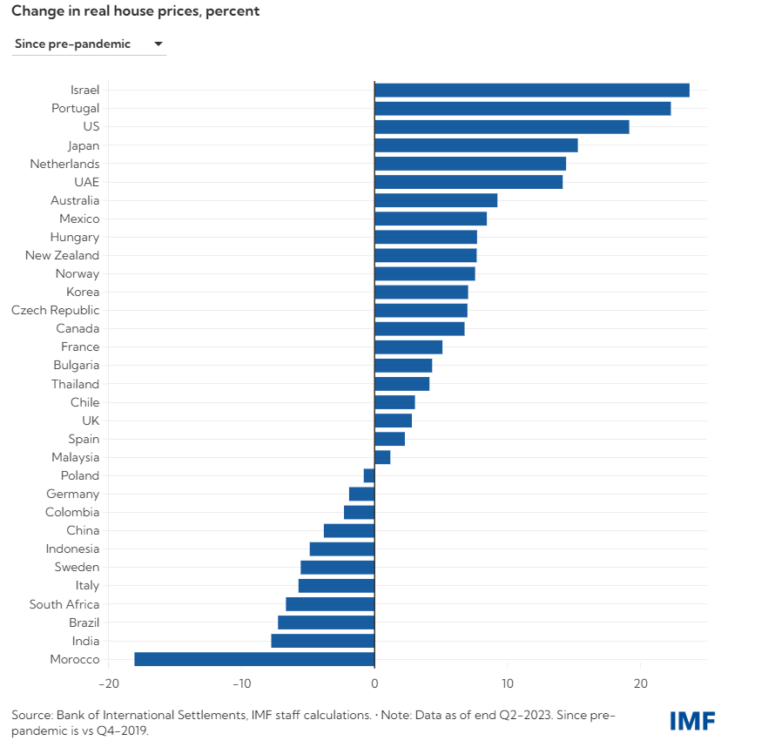

The rental industry has always played tug of war with traditional single family home buyers. As rents go up (economy willing), younger demographics are more pressured to invest in property of their own. But the opposite is also true. Housing prices are up almost 20% since pre pandemic levels, and the U.S. just recently brushed its economic fingers against a two-decade mortgage rate of 7.8%. From social media talking heads to Forbes reports and sweeping sentiments, the word on the street is wait and rent.

Chart source: The IMF Blog

A Rental.com report from late last year outlined the rise in rental demand. Those million new multifamily rental units we talked about? They’re being scooped up quickly. According to their September industry report, the average absorption rates of newly built apartments within three months of completion were 69.8% for affordable units and 57.2% for pricier units—a significant increase from the previous quarter.

The result of the increased demand has been a rise in rent rates in a few metropolitan areas throughout the U.S. The increase hasn’t been high enough to offset the national plateau, but it’s certainly noteworthy for anyone working in this industry. For scope, here’s a list of the many regions where rents fell:

Regions where rent decreased year-over-year in Q4 of 2023.

List Source: Realtor.com

| Metro | Median Rent (0-2 Bedrooms) | YOY (0-2 Bedrooms) |

| Atlanta-Sandy Springs-Roswell, GA | $1,659 | -4.9% |

| Austin-Round Rock, TX | $1,638 | -7.3% |

| Baltimore-Columbia-Towson, MD | $1,863 | 1.1% |

| Birmingham-Hoover, AL | $1,259 | 4.4% |

| Boston-Cambridge-Newton, MA-NH | $3,043 | 4.0% |

| Buffalo-Cheektowaga-Niagara Falls, NY | NA | NA |

| Charlotte-Concord-Gastonia, NC-SC | $1,604 | -2.2% |

| Chicago-Naperville-Elgin, IL-IN-WI | $1,801 | -0.6% |

| Cincinnati, OH-KY-IN | $1,261 | 3.6% |

| Cleveland-Elyria, OH | $1,264 | 3.2% |

| Columbus, OH | $1,205 | 2.1% |

| Dallas-Fort Worth-Arlington, TX | $1,530 | -6.2% |

| Denver-Aurora-Lakewood, CO | $1,957 | -1.0% |

| Detroit-Warren-Dearborn, MI | $1,312 | 2.1% |

| Hartford-West Hartford-East Hartford, CT | NA | NA |

| Houston-The Woodlands-Sugar Land, TX | $1,402 | 1.6% |

| Indianapolis-Carmel-Anderson, IN | $1,305 | 3.0% |

| Jacksonville, FL | $1,531 | 1.5% |

| Kansas City, MO-KS | $1,298 | 1.4% |

| Las Vegas-Henderson-Paradise, NV | $1,509 | -3.3% |

| Los Angeles-Long Beach-Anaheim, CA | $2,887 | -3.4% |

| Louisville/Jefferson County, KY-IN | $1,199 | 4.6% |

| Memphis, TN-MS-AR | $1,293 | -3.3% |

| Miami-Fort Lauderdale-West Palm Beach, FL | $2,486 | -2.4% |

| Milwaukee-Waukesha-West Allis, WI | $1,607 | 3.9% |

| Minneapolis-St. Paul-Bloomington, MN-WI | $1,513 | 1.2% |

| Nashville-Davidson–Murfreesboro–Franklin, TN | $1,649 | -0.2% |

| New Orleans-Metairie, LA | NA | NA |

| New York-Newark-Jersey City, NY-NJ-PA | $2,853 | 4.5% |

| Oklahoma City, OK | $1,008 | 2.5% |

| Orlando-Kissimmee-Sanford, FL | $1,710 | -5.4% |

| Philadelphia-Camden-Wilmington, PA-NJ-DE-MD | $1,790 | -0.4% |

| Phoenix-Mesa-Scottsdale, AZ | $1,563 | -5.2% |

| Pittsburgh, PA | $1,529 | 0.8% |

| Portland-Vancouver-Hillsboro, OR-WA | $1,681 | -5.4% |

| Providence-Warwick, RI-MA | NA | NA |

| Raleigh, NC | $1,562 | -4.3% |

| Richmond, VA | $1,533 | 4.6% |

| Riverside-San Bernardino-Ontario, CA | $2,316 | -1.6% |

| Rochester, NY | NA | NA |

| Sacramento–Roseville–Arden-Arcade, CA | $1,864 | -3.3% |

| San Antonio-New Braunfels, TX | $1,279 | -2.4% |

| San Diego-Carlsbad, CA | $2,891 | -2.0% |

| San Francisco-Oakland-Hayward, CA | $2,925 | -4.8% |

| San Jose-Sunnyvale-Santa Clara, CA | $3,305 | -0.6% |

| Seattle-Tacoma-Bellevue, WA | $2,058 | -3.9% |

| St. Louis, MO-IL | $1,346 | 3.0% |

| Tampa-St. Petersburg-Clearwater, FL | $1,720 | -3.9% |

| Virginia Beach-Norfolk-Newport News, VA-NC | $1,522 | 2.6% |

| Washington-Arlington-Alexandria,DC-VA-MD-WV | $2,238 | 4.2% |

So What’s on the Horizon for Multifamily?

Recession news: According to our nation’s fiercest economic minds, the possibility of a recession late this year or early next year has been and continues to be…sort of kind of maybe? Goldman Sachs insists there will be no recession in 2024. They are, in fact, predicting a cozy 4.2% increase in the S&P 500, buffing up the economy and padding businesses against stagnation.

Business Insider, on the other hand, is predicting a mid-year recession in 2024, to be followed by significant interest rate cuts. And by significant rate cuts, they mean significant—they’re expecting rates to plunge to just 1.25% in the first half of 2025.

And then TD Securities has extended a goldilocks prediction that threads the needle between the two extremes, forecasting a mild mid-year recession. And even that prediction is hedging their bets. They’ve put the odds of a U.S. recession at just 65%.

So who knows. At the end of the day, good multifamily business practices are good multifamily business practices. The threat of a recession and the unpredictability of rates certainly makes it harder to time investments in new properties, but operating leanly and efficiently is important whatever the weather.

Utility news: It’s a localized update, but one that’s representative of hikes throughout the nation. PG&E electric rates have exploded in California, outpacing an already high inflation rate and spooking customers. PG&E bills for the average residential customer have climbed 38% higher, matching up against an average 12.7% rise per year. What’s more, these hikes are happening alongside a series of state Public Utilities Commission hearings that could result in decisions which push PG&E gas and electricity bills up even more.

Of note: It’s no secret that conflicts in the middle east (of which there are currently many) can affect oil prices. And very few price hikes directly impact the cost of living or energy costs as significantly as oil prices. We will be keeping a watchful eye on the impact over the coming months.

Altogether Then

To reiterate the intro, the state of the market and its predictions for the coming several quarters are…weird. In previous years, we’ve had loud, clear trends with vivid (if unprecedented) factors to speak to.

But right now, we have a strange alchemy of new construction, high mortgage rates, and flat rents. We have the watery threat of a mid to late year recession. We have conflict in the middle east, and we have hot spots of rising utility costs breaking away from an already steady increase nationwide. And sitting ahead of all of these factors is an uncertain political future—because undoubtedly, the party that wins the 2024 presidential election will have a significant impact on our industry one way or the other.

Our shameless plug? Partner with Conservice for the stability and certainty we offer. Our ENTIRE corporate focus is on managing utilities for anyone who owns or manages a property. We stay abreast of region-specific utility regulations and compliance mandates. We have relationships with providers all over the country. And we measurably lower the cost of utility operations for our customers—a handy outcome when the economy gets shaky.

Subscribe To Our Blog Newsletter

Keep yourself ahead of the curve with the latest utility news, trends, & resources.

Editor's Picks

Keep the Heat On: Utility Assistance Resources for Property Teams This Winter

Record-breaking cold across the East is driving heating costs higher and putting pressure on residents and property teams alike.. Meanwhile, in our headquarters in Utah, we’re still scanning the mountains for snow (we’re not bitter). But across the country, winter…

Exploring the YoY Energy Price Hikes

Why Doing Everything Right Still Costs More First the lightning. Then the thunderclap. Right? The lightning. Over the last 18 months, AI, in all of its many and emerging forms, roared across the U.S. And while cultural and enterprise hesitance…

Onboard Is Now Conservice Internet Management

Since 2017, Onboard has been singularly focused on transforming how internet is delivered, supported, and monetized in the real estate industry. We’ve built a platform that simplifies bulk and non-bulk internet programs for owners, enhances the resident experience, and drives…

Senior Living Runs on Care (and Careful Utility Management)

Senior living operations exist for one main reason: to support residents. Every role, every process, and every decision ultimately serves people, not just systems. That focus is what makes the industry unique. And it’s also what makes operational strain show up more quickly when something falls out of balance.

The NOI Drain You Can’t See: How Utility Billing Errors Quietly Undermine Portfolio Performance

Identify and recover hidden utility billing errors that quietly drain NOI. Learn how a utility bill audit, automation, and expert review improve budget accuracy across multifamily and commercial portfolios.

Mid-Lease Enrollments: You’ve Signed a Bulk Internet Contract—Now What?

Signing an internet management contract is a big step forward. You’ve secured better pricing, guaranteed service levels, and one of the most in-demand amenities for your residents. But once the ink is dry, the real work begins: getting residents enrolled.

What the 2026 GRESB Updates Mean: Our Observations on the Key Shifts

Change is on the horizon. The 2026 GRESB Real Estate Standard marks a decisive move toward measurable, performance-based climate action. Rather than incremental adjustments, these updates focus attention on the issues that most directly shape long-term value and resilience. GRESB…

California AB1414: New Bulk Internet Opt-Out Law—What You Need to Know

New Requirements Go Into Effect January 1, 2026 California has officially passed AB1414, a bill that changes how property owners and operators can offer bulk internet services to residents. Beginning January 1, 2026, property owners must allow residents the ability…

Built to Go the Distance: How Properties Achieve ENERGY STAR, LEED, and WELL Certifications

We recently held our first 5K for our team, and it got us thinking. We watched many of our Experts who hadn’t run in years (or ever) lace up, train for weeks, and push through on the big day. The…

Smart Waste & Water Analytics: The Next Cost-Cutting Frontier in Multifamily

In this economy, cost control is on everyone’s mind. And energy and payroll usually top the list for multifamily operators. But here’s the thing: water and waste are two of the fastest-growing, least-managed costs eating into margins every day. Consider…

Experience Effortless Utility Management and Cost Savings

Connect with us today to discover how our solutions can ease tenant billback, streamline utility management, and reduce your costs and energy usage. Make your utility management smarter and more efficient with Conservice!