Each year, NAA Apartmentalize is split down the middle into two loud worlds: the vendor floor and the breakout sessions. On the vendor floor, you’ll be confronted by everything from rent optimization platforms to emotional support duck registration tools. It’s an awesome circus of opportunities, vendors, and so, so much swag. If you attended, we hope you stopped by our big beautiful booth, nabbed a drink, and let one of our Utility Experts hawk our wares at you.

But it’s the Apartmentalize sessions, that rich collection of panel discussions, presentations, and demonstrations, that are the focus of this article. Every year, we send out a small army of content experts to sleuth the various sessions and pocket away insights to collect in this article. It’s a rare moment when the multifamily industry comes together to itself about itself, and as a fundamental part of that industry from one coast to the other, it’s our responsibility to stay on top of and ahead of the trends impacting our customers.

The trends in question?

- The maturing of Build-to-Rent (BTR) as a rental product

- The AI-resident overload dilemma and how teams are adapting

- The evolving (and politically complicated) need for ESG credibility

Here’s what we learned.

BTR Hits Puberty: Growing Pains and Big Potential

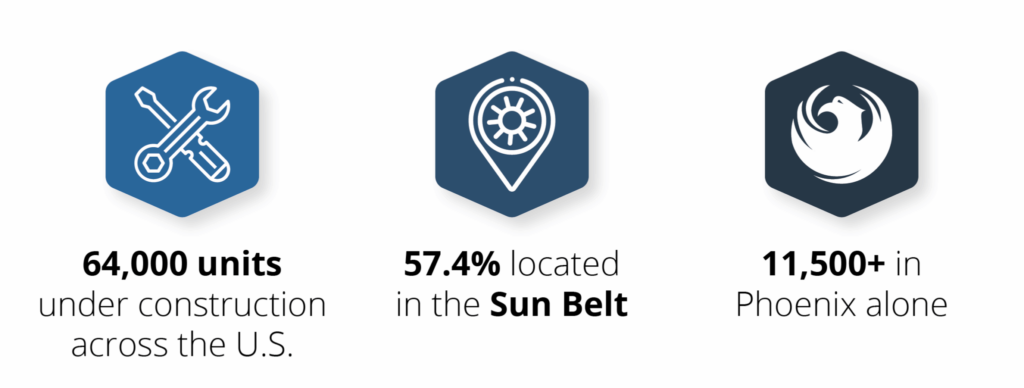

Fundamentally, Build-to-Rent is still a small fraction of the rental housing market, making up just 2% of market-rate product at the time of writing. Its growth, however, has been disproportionately fast and increasingly visible in the Sun Belt and secondary markets. As of June 2025, approximately 64,000 BTR units are under construction across the U.S., with the Sun Belt accounting for 57.4% of those builds. Phoenix alone has over 11,500 BTR units in development, highlighting a clear geographic center of gravity for this trend.

BTR Stat Snapshot (June 2025)

What became clear at the various NAA sessions we attended is that BTR isn’t really one thing. It’s a broad category encompassing single-family homes, cottage-style horizontal apartments, and multi-level townhomes. On the one hand, that variety engenders a lot of opportunity across a broad range of business structures and portfolio sizes. On the other hand, it could (and has) led to a lot of confusion for the marketing teams, leasing operations, and investors interested in leveraging BTR as a growth strategy.

The Unique Operational Challenges of BTR

Here’s a high-level summary of the BTR’s key challenges aggregated from our three days at NAA:

- Utility costs scale fast in two-level and detached homes, particularly without tight control over usage.

- Self-guided tours and lean staffing are the norm, but they’re not universally optimized.

- Communities often lease out of model homes or repurposed garages until full delivery, requiring more flexible workflows.

- Marketing requires strategic nuance—do you position it as a townhome or an apartment?

Fascinatingly, the renter base for BTR is also evolving. Shifting age demographics (and an increasingly oppressive market for would-be home buyers) have pushed “mid-phase” renters who value privacy and space (think young families, pet owners, remote workers, and downsizing Baby Boomers).

The Key Takeaway: BTR isn’t just a product—it’s a management model. One that requires operational systems (like utility management, self-tour tech, and strategic lead nurturing) designed for nuance, not uniformity.

AI is a Boon to Multifamily. But It’s Burning Out Your Staff.

Last year, AI was a topic of discussion at NAA. This year, it was a mature, dynamic arm of operations and was dissected, audited, and discussed ad nauseam. Nobody was really asking whether AI would impact multifamily operations, but how to best exploit its strengths and overcome its limitations.

And one of the limitations brought up in multiple sessions was the impact of personnel burnout.

ChatGPT and other generative tools have transformed leasing and marketing workflows for our industry. From content creation to lead nurture bots, automation is replacing repetitive work at scale. Performance Max campaigns in Google Ads, for example, have become a go-to for search marketers looking to consolidate spend and expand reach.

But many thought leaders throughout the conference warned that adoption is outpacing strategy. Frighteningly few firms admitted to designating AI oversight roles on their teams, and even fewer have established practical safeguards or policies around data usage, privacy, or legal compliance. In independent digital polls, the vast majority of responding attendees admitted that their teams were juggling too many AI tools, often with overlapping or conflicting outputs.

An overwhelmed leasing team doesn’t just suffer internally—it affects the resident experience. Dropped inquiries, inconsistent follow-ups, and robotic messaging risk alienating your most valuable asset: your people.

These insights were consistent with the broader industry trends we’ve written about right here on this blog. According to AppFolio, 94% of their property management clients are now using AI in some form. Yet many report difficulty in managing an increasingly fragmented tool stack. The more AI tools are leveraged for tasks like leasing, digital tours, etc., the more an increasingly patchwork maze of tools impacts measuring ROI metrics or building cross-functional governance.

The Key Takeaway: AI should evolve your workflows, not replicate them. Without strategic oversight—legal, IT, operations—AI risks overpromising, underdelivering, and burning out both your teams and your residents.

ESG is Politically Fraught. You’ll Have to Care Anyways.

So yeah, ESG as a corporate philosophy and operational strategy is under fire. On the one hand, its direct connection to regulations and diversity programs has made it a politically divisive topic for several years (so same old same old). On the other hand, the current federal administration has been outright savaging everything from Energy Star and aggressively withdrawing support for the enforcement of regulatory standards across the board.

The annual NAA legal update made clear that the current administration is actively pursuing a deregulatory agenda that includes eliminating or deprioritizing ESG mandates wherever possible—a shift which is already reshaping HUD funding and IRS tax priorities.

But of course, that deregulation has inflicted a seesaw effect on the state level. States are responding by ramping up their own ESG policies and disclosure rules, creating a fragmented regulatory landscape. The result is a confusing patchwork of expectations that vary not just by region, but sometimes by metro area. For multifamily owners and managers, it’s a headache and a liability.

Take California as a prime example: new legislation like SB 253 and SB 261 mandates GHG emissions and climate risk disclosures for large businesses operating in the state. These requirements extend far beyond traditional investor reporting and can impact operational decisions in real estate (Reuters).

GRESB and other global frameworks are becoming de facto standards not because of federal pressure, but because they provide a single, recognized methodology to demonstrate performance and mitigate risk.

The Key Takeaway: ESG is no longer optional, even if the federal government acts like it is. Property teams that adopt real frameworks now will be far better positioned to navigate future regulation, investor scrutiny, and resident expectations.

The One Common Thread: Specialized Focus

BTR is an incredibly nuanced and growing market. AI is a tech functionality that is creeping into our tech stacks faster than our personnel can effectively manage or leverage it. ESG is being pushed down by the federal government even as it’s being pointedly propped by state legislatures all over the country.

Anyone hawking a one-size-fits-all solution is selling wind.

As enchanting as simple answers to complicated questions are, NAA’s thought leaders and partners made it clear that the explosion in operational complications introduced by economic, political, and technological factors can’t be effectively absorbed by most multifamily companies without at least some level of disruption to the way they work. “That’s a reality we know intimately on the utility side. From regulatory whiplash to fractured provider networks to shifting resident expectations, utility management has become its own labyrinth—and increasingly, companies are recognizing that the best way to tackle that kind of complexity is to hand it off to someone who lives and breathes it. At Conservice, it’s not one thing we do. It’s the only thing we do.

Curious how Conservice is tackling these challenges for clients right now?

Reach out for a free consultation.

Subscribe To Our Blog Newsletter

Keep yourself ahead of the curve with the latest utility news, trends, & resources.

Editor's Picks

New Rules. Same Old Trash. Ask an Expert with Tedd Schonsheck

Meet Tedd Schonsheck: Waste strategist. Former Army officer. Recovering retail executive. Now, he’s one of the people dedicated to making sure trash actually works for property owners and managers.

Climate Risk Is Now a Portfolio Allocation Question, Not a Reporting Exercise

A practical framework for screening climate risk in multifamily portfolios and identifying market and asset hotspots.

Keep the Heat On: Utility Assistance Resources for Property Teams This Winter

Record-breaking cold across the East is driving heating costs higher and putting pressure on residents and property teams alike.. Meanwhile, in our headquarters in Utah, we’re still scanning the mountains for snow (we’re not bitter). But across the country, winter…

Exploring the YoY Energy Price Hikes

Why Doing Everything Right Still Costs More First the lightning. Then the thunderclap. Right? The lightning. Over the last 18 months, AI, in all of its many and emerging forms, roared across the U.S. And while cultural and enterprise hesitance…

Onboard Is Now Conservice Internet Management

Since 2017, Onboard has been singularly focused on transforming how internet is delivered, supported, and monetized in the real estate industry. We’ve built a platform that simplifies bulk and non-bulk internet programs for owners, enhances the resident experience, and drives…

Senior Living Runs on Care (and Careful Utility Management)

Senior living operations exist for one main reason: to support residents. Every role, every process, and every decision ultimately serves people, not just systems. That focus is what makes the industry unique. And it’s also what makes operational strain show up more quickly when something falls out of balance.

The NOI Drain You Can’t See: How Utility Billing Errors Quietly Undermine Portfolio Performance

Identify and recover hidden utility billing errors that quietly drain NOI. Learn how a utility bill audit, automation, and expert review improve budget accuracy across multifamily and commercial portfolios.

Mid-Lease Enrollments: You’ve Signed a Bulk Internet Contract—Now What?

Signing an internet management contract is a big step forward. You’ve secured better pricing, guaranteed service levels, and one of the most in-demand amenities for your residents. But once the ink is dry, the real work begins: getting residents enrolled.

What the 2026 GRESB Updates Mean: Our Observations on the Key Shifts

Change is on the horizon. The 2026 GRESB Real Estate Standard marks a decisive move toward measurable, performance-based climate action. Rather than incremental adjustments, these updates focus attention on the issues that most directly shape long-term value and resilience. GRESB…

California AB1414: New Bulk Internet Opt-Out Law—What You Need to Know

New Requirements Go Into Effect January 1, 2026 California has officially passed AB1414, a bill that changes how property owners and operators can offer bulk internet services to residents. Beginning January 1, 2026, property owners must allow residents the ability…

Experience Effortless Utility Management and Cost Savings

Connect with us today to discover how our solutions can ease tenant billback, streamline utility management, and reduce your costs and energy usage. Make your utility management smarter and more efficient with Conservice!