Trying to gauge where your sustainability strategy stands right now? You’re not alone. Policies shift. Executive orders fly. And yet, many companies are still pushing forward. The challenge? Staying on top of changing federal, state, and local-level requirements, all while balancing investor expectations and meeting customer needs.

President Trump made headlines when he withdrew the United States from the Paris climate agreement on his first day back in office in January. That marked his second withdrawal from the accord, following the same move during his first term. Since returning to office, his administration has issued a steady stream of executive orders aimed at rolling back environmental regulations and promoting fossil fuel development.

In April, a new executive order directed the Department of Justice to block states from enforcing ESG mandates. As a result, many property owners and operators were left wondering what’s next for environmental compliance. Let’s take a closer look at what today’s shifting landscape means for property management.

First Up, Federal Environmental Regulations

At the federal level, environmental regulations are anything but settled.

Greenhouse Gas Reporting Program (GHGRP)

At the time of this writing, the Environmental Protection Agency (EPA) is reconsidering the mandatory GHGRP, which requires about 8,000 facilities and suppliers nationwide to report their annual emissions. They argue that while the program imposes significant compliance costs on businesses, it may not be delivering meaningful environmental benefits in its current form.

The Trump administration has proposed shifting more authority to states, giving them greater control over emissions oversight. This aligns with its broader goal of reducing federal regulatory reach and reinforcing U.S. leadership in energy production and independence.

SEC Climate Disclosure Rules

In 2024, the Securities and Exchange Commission (SEC) finalized rules requiring public companies to disclose climate-related risks and material greenhouse gas emissions. However, the rule was stayed following legal challenges and is now pending court review. The SEC, under the direction of the Trump administration, has indicated its intent to rescind or significantly revise the disclosure rules. One legal expert commented that this shift “effectively ends climate disclosure requirements” for public companies, at least through the remainder of this term.

The SEC said its final rules were designed to give investors more consistent, comparable, and reliable details about how climate risks could affect a company’s finances and operations while also trying to keep the costs of reporting from becoming too heavy for businesses.

For publicly traded companies, this means greenhouse gas emissions reporting may not be required at the federal level for the foreseeable future. But federal deregulation doesn’t eliminate the growing expectations from investors, customers, and local authorities.

How About State Environmental Regulations?

Trump’s April executive order empowers the Attorney General to identify and challenge state laws seen as restricting domestic energy use. So far, no state laws have been formally challenged, but legal battles could emerge at any time.

In response to federal rollbacks, many states have proactively advanced their own climate policies:

- California adopted its own climate disclosure law in 2023, setting aggressive standards for corporate climate disclosures.

- Colorado introduced a similar climate disclosure bill in January 2025.

- New York lawmakers introduced a corporate data accountability bill that, if passed, would impose similar state-level disclosure requirements.

- New Mexico continues pursuing policies designed to move the state toward net-zero emissions by 2050.

Additionally, 24 governors representing a majority of the U.S. economy and population have formed the U.S. Climate Alliance. Despite federal pushback, these states remain committed to achieving the Paris Agreement’s climate goals. The alliance has announced it will fight any federal efforts to obstruct state-level environmental regulations, signaling that significant legal and political battles could unfold in the coming years.

Let’s Talk Local-Level Regulations

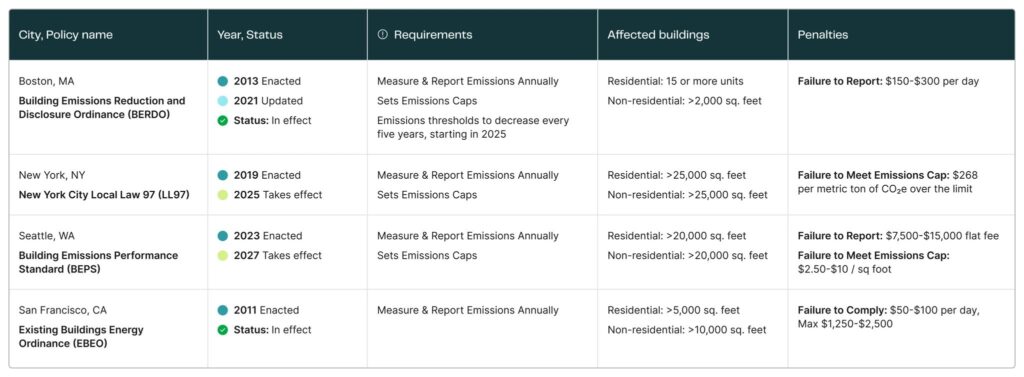

States aren’t alone in driving climate action. A number of cities have also implemented their own building emissions regulations:

- Boston, New York, Seattle, and San Francisco require building emissions reporting and management.

- Dozens of other municipalities have adopted energy codes that mandate sustainable building features, including high-efficiency HVAC systems, low-energy lighting, water-saving fixtures, and green construction standards.

As urban centers face increasing climate impacts, many cities view aggressive emissions reduction as a local necessity. This decentralized approach creates a complex regulatory patchwork for property owners and operators to navigate, even if federal oversight wanes.

Beyond Regulation: Why ESG Momentum Continues

Federal ESG regulations will shift, but market demand for sustainability continues to gain momentum. Companies across industries are finding that responsible environmental practices meet not only regulatory expectations, but also the expectations of customers, residents, and investors.

According to Construction Dive, developers and property owners are staying committed to sustainability initiatives because they align with business interests and customer demand. The 2024 AMLI Residential Sustainability Living Index found that:

- 46% of residents considered green features in their rental decisions.

- 79% believe that sustainable living environments positively impact their health.

For property owners and operators, sustainability features can directly contribute to stronger resident retention, higher occupancy rates, and greater rent premiums.

The Business Case for Sustainability & Compliance

Beyond customer appeal, sustainability investments often make financial sense. Energy-efficient systems lower operating costs. Renewable energy procurement can help stabilize long-term energy expenses. Waste reduction initiatives lead to lower disposal costs. And even seemingly small adjustments, like optimizing water usage, can drive meaningful savings at scale.

Businesses that proactively pursue energy efficiency, emissions reductions, and ESG best practices may unlock more than cost savings and operational efficiencies. They position themselves for value creation, increased capital access, and long-term growth. Our ESG value creation framework highlights 10 clear pathways organizations can take to turn sustainability into tangible business value.

Rebranding for the Long-Term

Public discourse around “ESG” has always been politicized. And now many businesses are choosing to reposition or rename their programs under broader umbrellas like “Corporate Responsibility,” “Sustainability Services,” or “Impact Management.” The language may shift, but the goals and underlying practices remain largely the same without getting caught in political crossfire.

Whether your organization calls it ESG or something else, the deeper momentum behind sustainability continues to accelerate, driven by market forces, customer expectations, and long-term business resilience.

Navigating the Complexity: How Conservice Can Help

We work alongside property owners and operators across multifamily, single family, BTR, manufactured housing, student housing, senior living, commercial, and beyond. For developers who want to simplify environmental compliance and maximize the business value of sustainability, our ESG solutions help you:

- Simplify complex reporting requirements

- Maintain compliance across local, state, and federal regulations

- Increase resident retention through sustainable amenities

- Attract investors by prioritizing responsible business practices

- Lower energy rates through smarter procurement

- Identify opportunities for operational improvement

- Reduce waste and environmental impact

Policies and regulations will also change. S tracking compliance isn’t just about following the rules. It’s about protecting your brand, meeting customer expectations, and strengthening your bottom line. No matter who’s in office, a proactive approach to ESG management will remain a smart business strategy.

Want to learn more? Connect with an Expert.

Subscribe To Our Blog Newsletter

Keep yourself ahead of the curve with the latest utility news, trends, & resources.

Editor's Picks

Keep the Heat On: Utility Assistance Resources for Property Teams This Winter

Record-breaking cold across the East is driving heating costs higher and putting pressure on residents and property teams alike.. Meanwhile, in our headquarters in Utah, we’re still scanning the mountains for snow (we’re not bitter). But across the country, winter…

Exploring the YoY Energy Price Hikes

Why Doing Everything Right Still Costs More First the lightning. Then the thunderclap. Right? The lightning. Over the last 18 months, AI, in all of its many and emerging forms, roared across the U.S. And while cultural and enterprise hesitance…

Onboard Is Now Conservice Internet Management

Since 2017, Onboard has been singularly focused on transforming how internet is delivered, supported, and monetized in the real estate industry. We’ve built a platform that simplifies bulk and non-bulk internet programs for owners, enhances the resident experience, and drives…

Senior Living Runs on Care (and Careful Utility Management)

Senior living operations exist for one main reason: to support residents. Every role, every process, and every decision ultimately serves people, not just systems. That focus is what makes the industry unique. And it’s also what makes operational strain show up more quickly when something falls out of balance.

The NOI Drain You Can’t See: How Utility Billing Errors Quietly Undermine Portfolio Performance

Identify and recover hidden utility billing errors that quietly drain NOI. Learn how a utility bill audit, automation, and expert review improve budget accuracy across multifamily and commercial portfolios.

Mid-Lease Enrollments: You’ve Signed a Bulk Internet Contract—Now What?

Signing an internet management contract is a big step forward. You’ve secured better pricing, guaranteed service levels, and one of the most in-demand amenities for your residents. But once the ink is dry, the real work begins: getting residents enrolled.

What the 2026 GRESB Updates Mean: Our Observations on the Key Shifts

Change is on the horizon. The 2026 GRESB Real Estate Standard marks a decisive move toward measurable, performance-based climate action. Rather than incremental adjustments, these updates focus attention on the issues that most directly shape long-term value and resilience. GRESB…

California AB1414: New Bulk Internet Opt-Out Law—What You Need to Know

New Requirements Go Into Effect January 1, 2026 California has officially passed AB1414, a bill that changes how property owners and operators can offer bulk internet services to residents. Beginning January 1, 2026, property owners must allow residents the ability…

Built to Go the Distance: How Properties Achieve ENERGY STAR, LEED, and WELL Certifications

We recently held our first 5K for our team, and it got us thinking. We watched many of our Experts who hadn’t run in years (or ever) lace up, train for weeks, and push through on the big day. The…

Smart Waste & Water Analytics: The Next Cost-Cutting Frontier in Multifamily

In this economy, cost control is on everyone’s mind. And energy and payroll usually top the list for multifamily operators. But here’s the thing: water and waste are two of the fastest-growing, least-managed costs eating into margins every day. Consider…

Experience Effortless Utility Management and Cost Savings

Connect with us today to discover how our solutions can ease tenant billback, streamline utility management, and reduce your costs and energy usage. Make your utility management smarter and more efficient with Conservice!