If you haven’t been living under a rock, you know ESG is undergoing a metamorphosis. With the rollback of DEI earlier this year, ESG has been cocooned in regulatory and federal uncertainty.

But something clearer and more actionable has emerged from the pressures of that cocoon: corporate responsibility. With sharper focus, growing regulation, and increasing investor pressure, the conversation has matured from abstract ideals to concrete expectations. And if you’re tracking with GRESB, you know it’s time to move from reacting to planning.

Embark on the Next Leg of Your GRESB Journey

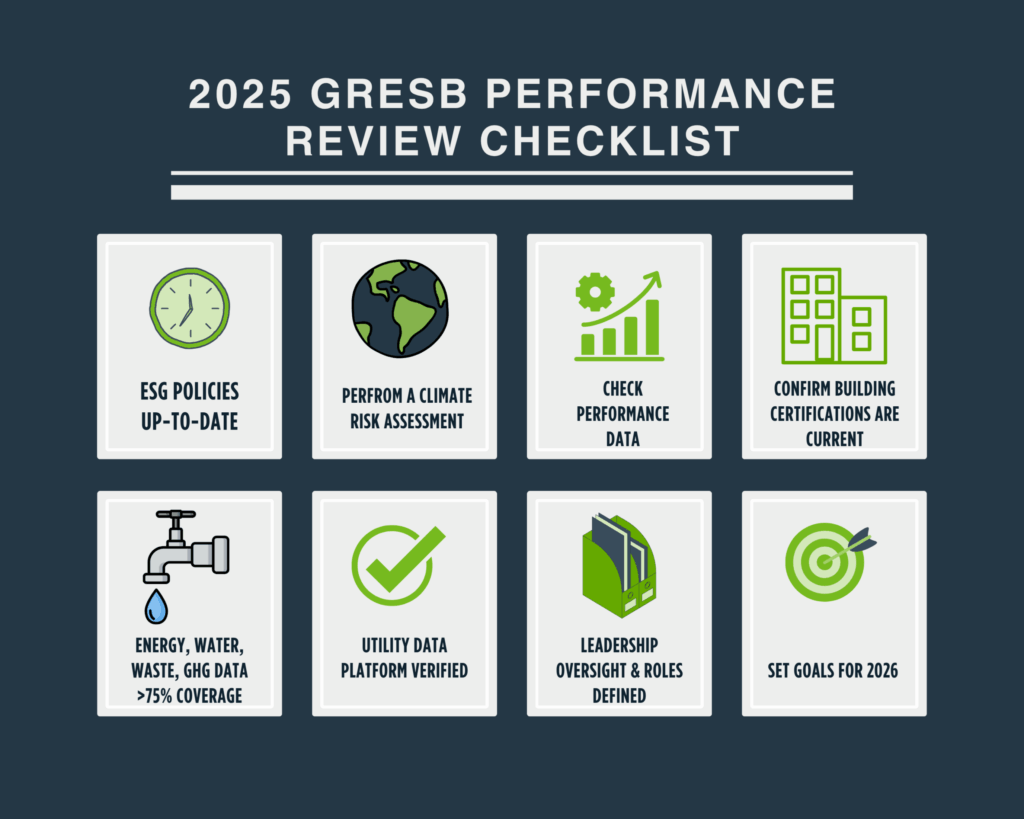

If 2025 was about charting your corporate responsibility course, 2026 is the time to set sail. GRESB submission season might feel like a distant port, but seasoned sustainability teams know that year-round planning is crucial. By building a clear, achievable checklist now, you can stay ahead of evolving standards, streamline data collection, and ensure your performance reflects the real progress you’re making.

If you haven’t yet explored the new 2025 portal updates, catch up here: What’s New in the GRESB 2025 Portal

Plot Your Route: Budgeting & Building Support

Start plotting for success by reviewing your 2025 performance. Where did your portfolio shine, and where did it stall? This insight fuels 2026 budgeting discussions with concrete asks—whether it’s allocating funds for certifications, expanding data coverage, or investing in energy efficiency upgrades that support long-term goals.

Don’t underestimate the power of investor relations. As GRESB’s influence grows, so does investor scrutiny. Come to the table prepared with a roadmap for improved performance and a vision that links ESG progress to portfolio value.

Watch the Horizon: Potential GRESB Changes Ahead

While GRESB hasn’t yet released guidance for 2026, the winds of change are always blowing. Stay alert for:

- Expanded asset-level data requirements

- More robust verification expectations

- Growing alignment with global disclosure standards (like CSRD, TCFD)

The earlier you identify gaps, the smoother your journey next spring. And remember, each certification you earn could be wind in your sails. See how green building certifications can level up your score in our blog:

Achieving GRESB Gains: Level Up with Green Building Certifications

Keep the Compass on Corporate Responsibility

GRESB isn’t just a score—it’s a signal. A strong submission demonstrates your commitment to environmental stewardship, social engagement, and sound governance. That makes it a powerful tool for investor trust, tenant attraction, and brand reputation.

Let’s Cruise Together

Compliance doesn’t have to be a stormy ride. With the right partner, the journey can be smooth, strategic, and even exciting. If you’re looking to optimize utility data, expand energy insights, or tackle compliance complexity, Conservice can help you stay on course.

Subscribe To Our Blog Newsletter

Keep yourself ahead of the curve with the latest utility news, trends, & resources.

Editor's Picks

What the 2026 GRESB Updates Mean: Our Observations on the Key Shifts

Change is on the horizon. The 2026 GRESB Real Estate Standard marks a decisive move toward measurable, performance-based climate action. Rather than incremental adjustments, these updates focus attention on the issues that most directly shape long-term value and resilience. GRESB…

Read MoreCalifornia AB1414: New Bulk Internet Opt-Out Law—What You Need to Know

New Requirements Go Into Effect January 1, 2026 California has officially passed AB1414, a bill that changes how property owners and operators can offer bulk internet services to residents. Beginning January 1, 2026, property owners must allow residents the ability…

Read MoreBuilt to Go the Distance: How Properties Achieve ENERGY STAR, LEED, and WELL Certifications

We recently held our first 5K for our team, and it got us thinking. We watched many of our Experts who hadn’t run in years (or ever) lace up, train for weeks, and push through on the big day. The…

Read MoreSmart Waste & Water Analytics: The Next Cost-Cutting Frontier in Multifamily

In this economy, cost control is on everyone’s mind. And energy and payroll usually top the list for multifamily operators. But here’s the thing: water and waste are two of the fastest-growing, least-managed costs eating into margins every day. Consider…

Read MoreYour Utilities Might Be Lying to You.

Preventing Losses from Errors, Theft, and Oversight. Utilities don’t always tell the whole truth. At least not without a little verification. Between billing errors, meter issues, and missed rate updates, it’s easy for even the most diligent property teams to…

Read MoreThe First Bills Are In. Here’s What Early Utility Data Reveals About Student Housing

Move-in day has come and gone. The carpets are clean, the furniture is set, and the flood of parents and students with boxes and carts has finally slowed. For operators, the chaos of Turn is behind them. But another wave…

Read MoreMeet the New Goby Dashboard That Turns Sustainability Data Into Action

Conservice is excited to introduce a new dashboard for Goby, our sustainability and compliance platform. Goby has always helped real estate owners and operators manage utility and sustainability data across their portfolios. With this release, the platform now delivers insights faster,…

Read MoreUtility Data Centralization: Unlocking AI, Energy, and Sustainable Solutions

Let me tell you a secret. If you were to take over my computer at any given moment, you’d probably find 30 tabs, 10 apps, and a spreadsheet all open at once. I’ll admit it: I’m no expert at centralizing…

Read MoreThe Hidden Engine Driving Build-to-Rent in 2025

When the Smiths moved into a brand‑new rental home last spring, they didn’t just discover fresh flooring or smart thermostats; they stepped into a lifestyle shaped by seamless utility management. They never saw a bill go astray, never gawked at…

Read MoreENERGY STAR Portfolio Manager: What’s Really Happening and How to Protect Your Data

If you work in property management or sustainability, you’ve probably heard the headlines. Back in May, several news outlets reported that the federal ENERGY STAR program (including ENERGY STAR Portfolio Manager) could be eliminated. The reality in August 2025 looks…

Read MoreExperience Effortless Utility Management and Cost Savings

Connect with us today to discover how our solutions can ease tenant billback, streamline utility management, and reduce your costs and energy usage. Make your utility management smarter and more efficient with Conservice!